Updated June 14, 2021

XIFIN analyzed its vast stores of data, representative of four out of five top integrated delivery networks (IDNs) and ten out of the top 12 public laboratories nationwide, to craft the Lab Volume Index. Access interactive charts and weekly updates at www.xifin.com/index

Currently, XIFIN sees 15-20% of all COVID-19 testing claims nationwide. The Lab Volume Index synthesizes billing volume data into a measurement of testing volumes as compared to a pre-coronavirus testing average (“baseline”). Its synthesis of lab billing data into a measurement of testing volumes enables comparisons of routine laboratory testing, COVID-19 testing, and antibody testing both over time and across key laboratory segments: clinical, hospital, molecular, anatomic pathology, and pain/tox. Baseline volume is an average of weekly volumes represents current year pre-COVID-19 testing volumes. The Lab Volume Index measures billing volume data against a baseline volume, expressed as a percent of baseline.

Here’s the week’s synopsis:

Testing Volumes Recover from Holiday Week

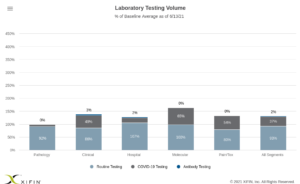

After last week’s dip—due to the Memorial Day holiday—this week finds testing volumes bouncing back and putting them back on track to continue an overall trend of incremental steps back toward baseline. This week, overall volume increased 14 percentage points to 138% of baseline, offsetting most of the 18% decrease from the prior week (that was due in part to the shortened week). Since total testing volumes peaked in January, they have averaged a drop of four percentage points per week. Routine testing volumes also increased week over week, up 15% to 100% of baseline, which is 2 percentage points higher than volumes were the week before Memorial Day week. Conversely, COVID testing continued its ongoing downturn, with no significant rebound from the prior week. COVID testing finished the week at 38% of baseline, 2 percentage points below the prior week’s volume, and 6 percentage points below the week before that. antibody testing volumes are once again 2% of baseline. Interactive versions of these charts are available at https://www.xifin.com/index

All segments remain above baseline volumes overall. Molecular continues to see the highest volume relative to baseline (170%), and Pathology has the lowest volume, at 101% of baseline. Hospital and Molecular are the only segments to have routine testing above baseline. Pathology, Pain/tox, and Clinical routine testing volumes remain five to ten percentage points below baseline. Here is a segment-by-segment breakdown:

- Molecular increased 11 percentage points overall, which was comprised of a 8% drop in COVID-19 testing, and a 19% increase in routine testing. Finishing the week at 170% of baseline, the segment continues to lead the pack in overall testing volume.

- Pain/tox labs saw a big swing week over week, up 21% in overall testing to finish the week at 145% of baseline. With no week over week change in COVID-19 testing, the bounce is entirely attributed to routine testing increases. This week’s increase mostly offset the 29% decrease seen the previous holiday week.

- Pathology notched a 6% overall increase, with a negligible drop in COVID-19 testing, the increase is almost entirely in routine testing. Overall, the segment is at 101% of baseline, up from the prior holiday week’s 96%.

- Clinical lab volumes increased 13% overall to finish the week at 144% of baseline. COVID-19 testing declined 2 percentage points over the prior week, dropping the volume below 50% of baseline to finish at 48%.

- Hospital lab volumes recovered 16% overall, to finish the week at 135% of baseline. This exactly offset the prior week’s holiday dip. With no change in COVID-19 testing volumes, the change is entirely due to increases in routine testing.